Social security retirement calculator 2021

And if you reached full retirement age in 2021 the Social Security Administration raises the earnings limit up to 50520. The RAS stops the month you turn age 62 regardless of whether you start drawing Social Security at age 62.

Calculating Social Security Benefits A Hypothetical Example Of A Higher Download Table

2 thoughts on Retirement Calculator With Social Security 401k Roth IRA.

. Its a good idea to check back with a. Once youre ready to apply the easiest way to complete your application is online. Originally Social Securitys full retirement age was set at 65 for all beneficiaries but the Social Security Amendment of 1983 gradually raised the full retirement age to 67.

A worker who is of full retirement age or older may with spouse keep all benefits after taxes regardless of earnings. The OPM dedicates an entire chapter in its CSRS and FERS Handbook to these and other details on the RAS. The highest amount that a person who submits a claim for pension benefits from social security in 2021 can receive per.

Our Online Calculator gives. Multiply that by 12 to get 50328 in maximum annual benefits. For example in December 2021 you should get an increase for your 2020 earnings if those earnings raised your benefit.

She appealed the decision and won. Start Planning Retirement Now Lisa. The Social Security programs benefits include retirement income disability income Medicare.

You can apply four months before you want your Social Security retirement benefits to start. Rights at work EU employment legislation guarantees minimum levels of protection that apply to everyone living and working in the EU. Tax-Free Retirement Withdrawals.

We estimate your Social Security income using your stated annual income and assuming you have worked and paid Social Security taxes for 35 years prior to retirement. The OPM also provides Frequently Asked Questions on the supplement. For reference the average Social Security retirement benefit in May 2022 was 1668 a month.

Our estimate is sensitive to penalties for early retirement and credits for delaying claiming Social Security benefits. For example if you worked as an engineer for 20 years before you began teaching you may be able to do enough part time work between now and when you retire to completely. It means the system will exhaust its.

The Year You Reach Your Full Retirement Age. Your total retirement income includes any available pension and Social Security. According to the 2022 annual report of the Social Security Board of Trustees the surplus in the trust funds that disburse retirement disability and other Social Security benefits will be depleted by 2035Thats one year later than the trustees projected in their 2021 report.

If you need further assistance call us at 1-800-772-1213 or you can contact your local Social Security office. The European Pillar of Social Rights sets out 20 key principles and rights to support fair and well-functioning labour markets and welfare systems. Benefit changes each year.

If you need further assistance call us at 1-800-772-1213 or you can contact your local Social Security office. Depending on your birth year your full retirement age will be from 65 to 67. For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021.

2324 for a person filing at 62. Jane also received 5000 in social security benefits in 2021 so her total benefits in 2021 were 11000. For the 2022 tax year the yearly earnings limit is 19560.

If you are younger than full retirement age during all of 2022 the Social Security Administration will deduct 1 from your Social Security paycheck for every 2 you earn above the annual limit. Hi James thanks for using our blog to ask your question. This is the age you plan to retire.

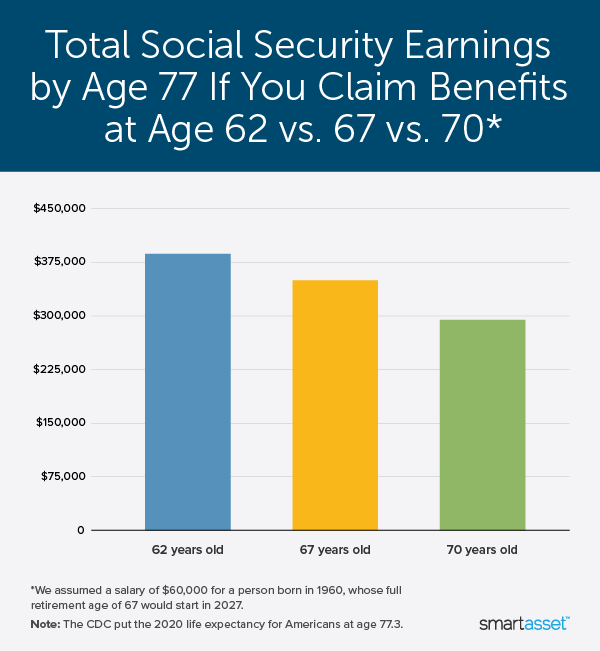

If you are looking to retire in conjunction with social security benefits the Social Security Administration explains that age 62 is the earliest you can collect social security retirement benefits. A United States federal program of social insurance and benefits developed in 1935. As of 2021 the maximum a person can contribute to a Roth IRA Account is 6000 per year.

Maybe you chose to receive reduced Social Security retirement benefits while continuing to work. This is an automatic process and benefits are paid in December of the following year. Use the calculator below to estimate your Social Security income for 2022.

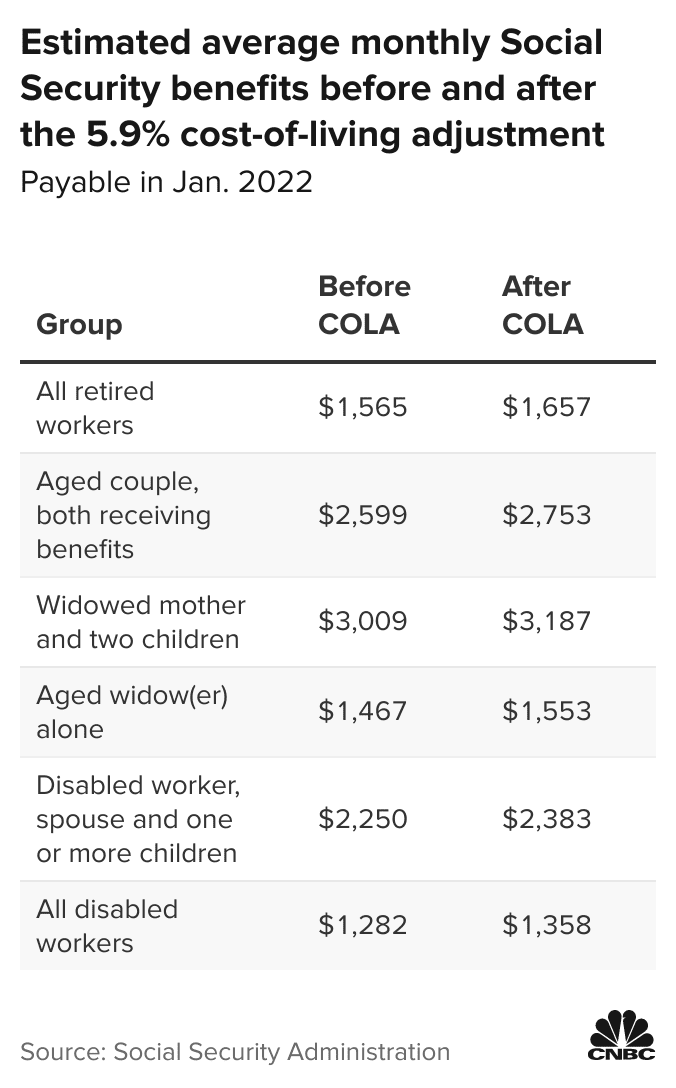

Our Retirement Savings Calculator asks for your annual pension benefit at retirement and whether it increases with inflation. That does not mean Social Security will no longer be around. Also known as COLA it will be a 59 increase over the 2021 amount you receive.

3895 for a person submitting application at age 70. And even if you have other income sources in retirement Social Security can make up a significant part of your. Your primary insurance amount PIA is the amount of your monthly retirement benefit if you file for it at your full retirement age.

This means that the Social Security Administration will deduct 1 from benefits for every 2 that you earned over 18960. Which is 142800 as of 2021. You can get an estimate of your PIA from your Social Security statement more details hereYou can also call the SSA to request that they calculate your PIA or you can calculate it yourself with the calculator at SSAtools.

In this case it is possible to get Social Security retirement or survivors benefits and work at the same time. February 22 2022 at 946 pm. For a worker claiming Social Security in 2022 at full retirement age the highest monthly amount is 3345.

Thats about double the average retirement benefit 1666 in April 2022. Tier 1 railroad retirement benefits are the part of benefits that a railroad employee or beneficiary would have been entitled to receive under the social security system. If social security benefits are received amounts from Box 5 on Form SSA-1099.

For 2022 that limit is 19560. In addition you can choose whether or not to include Social Security benefits in your retirement analysis results. Basic information to help you determine your gross income.

In 2020 she applied for social security disability benefits but was told she was ineligible. You can apply four months before you want your Social Security retirement benefits to start. Whats the maximum monthly Social Security benefit.

Your Monthly Social Security. To draw the top benefit your earnings must have exceeded Social Securitys maximum taxable income the. If workers and employers each paid 76 up.

Increase Social Security taxes. Enter your current monthly Social Security SSDI SSI income in the first field labeled Enter Monthly SSSSDISSI Income and the calculator will do the rest. Hi James thanks for using our blog to ask your question.

The maximum benefit the most an individual retiree can get is 3345 a month for someone who files for Social Security in 2022 at full retirement age FRA the age at which you qualify for 100 percent of the benefit calculated from your. In 2021 she received a lump-sum payment of 6000 of which 2000 was for 2020 and 4000 was for 2021. 3148 for a person submitting full retirement age currently 66 and 2 months.

The RAS has no impact on your eventual Social Security annuity. Use our Social Security Full Retirement Age calculator to pin it down If you take benefits before FRA your benefits will be reduced. This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax.

Once youre ready to apply the easiest way to complete your application is online.

Could 2023 Social Security Cola Hit 9 Benefitspro

/GettyImages-149357059-b06074af5ea4494aba83d73a3755f261.jpg)

How Do I Calculate My Social Security Breakeven Age

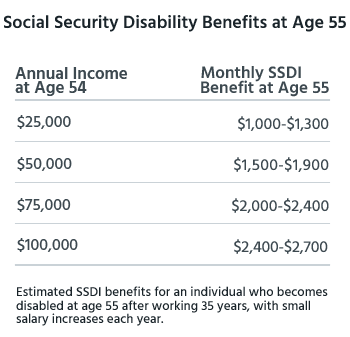

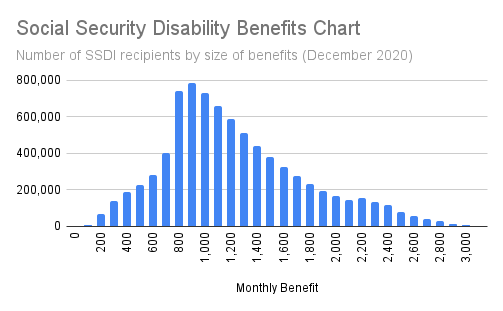

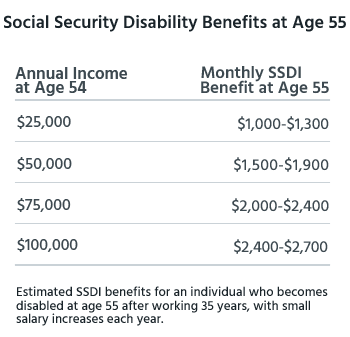

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

Social Security Benefits Tax Calculator

This Chart Shows Why You Shouldn T Wait To Claim Social Security

This Chart Shows Why You Shouldn T Wait To Claim Social Security

Calculating Social Security Benefits A Hypothetical Example Of A Higher Download Table

Try Our Social Security Calculator In 2021 Money Management Advice Money Saving Strategies Money Saving Strategies Budgeting Money Money Management Advice

How To Calculate Social Security Benefits 3 Easy Steps Youtube

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

American Retirement Is Little Changed A Year After Covid 19 Forbes Advisor

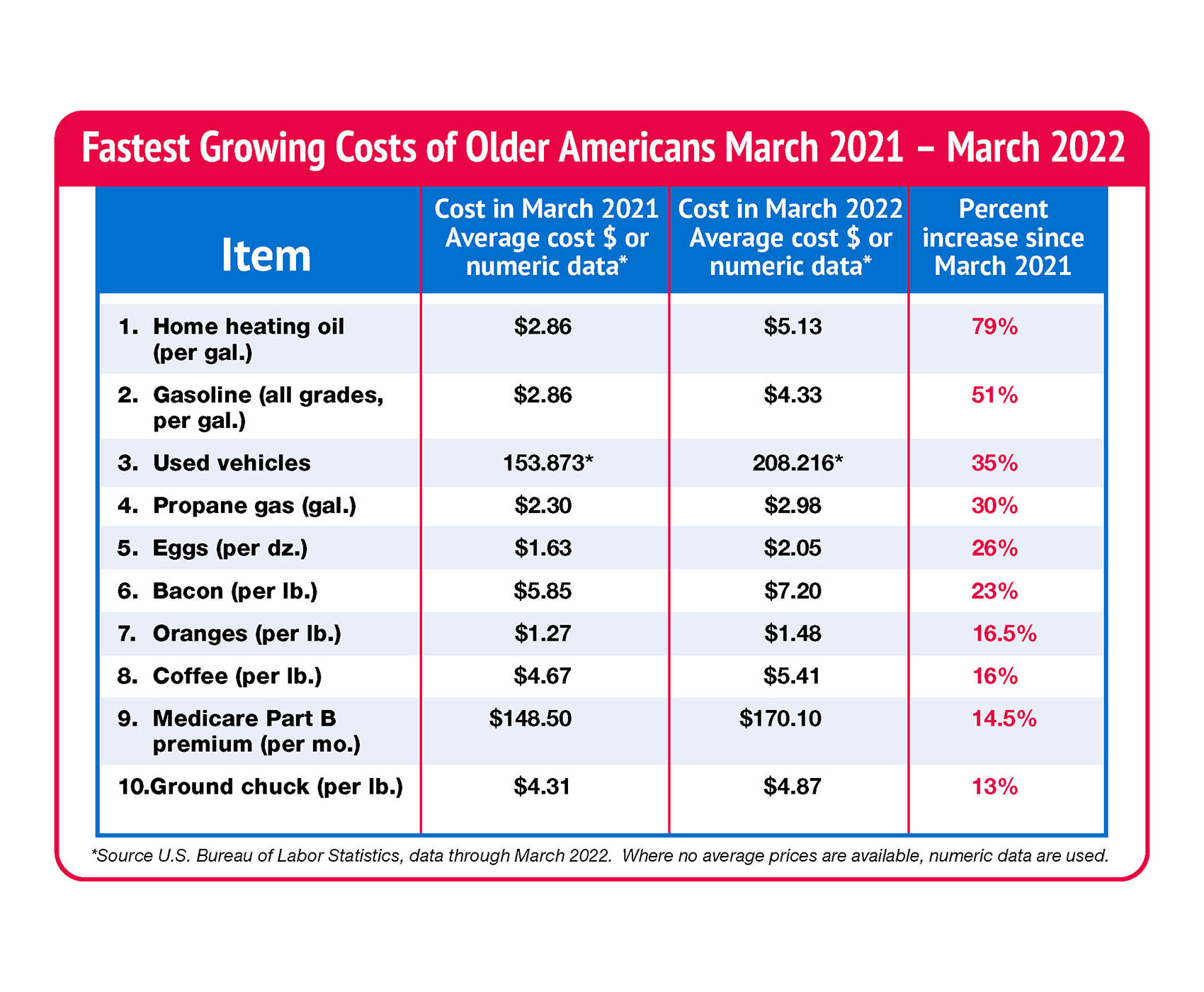

Social Security Benefits Lose 40 Of Buying Power Cola For 2023 Could Be 8 6 The Senior Citizens League

Social Security Cola How To Estimate Your Monthly Payments For 2022

Social Security Sers

2022 Social Security Disability Benefits Pay Chart 2021 For Dependents